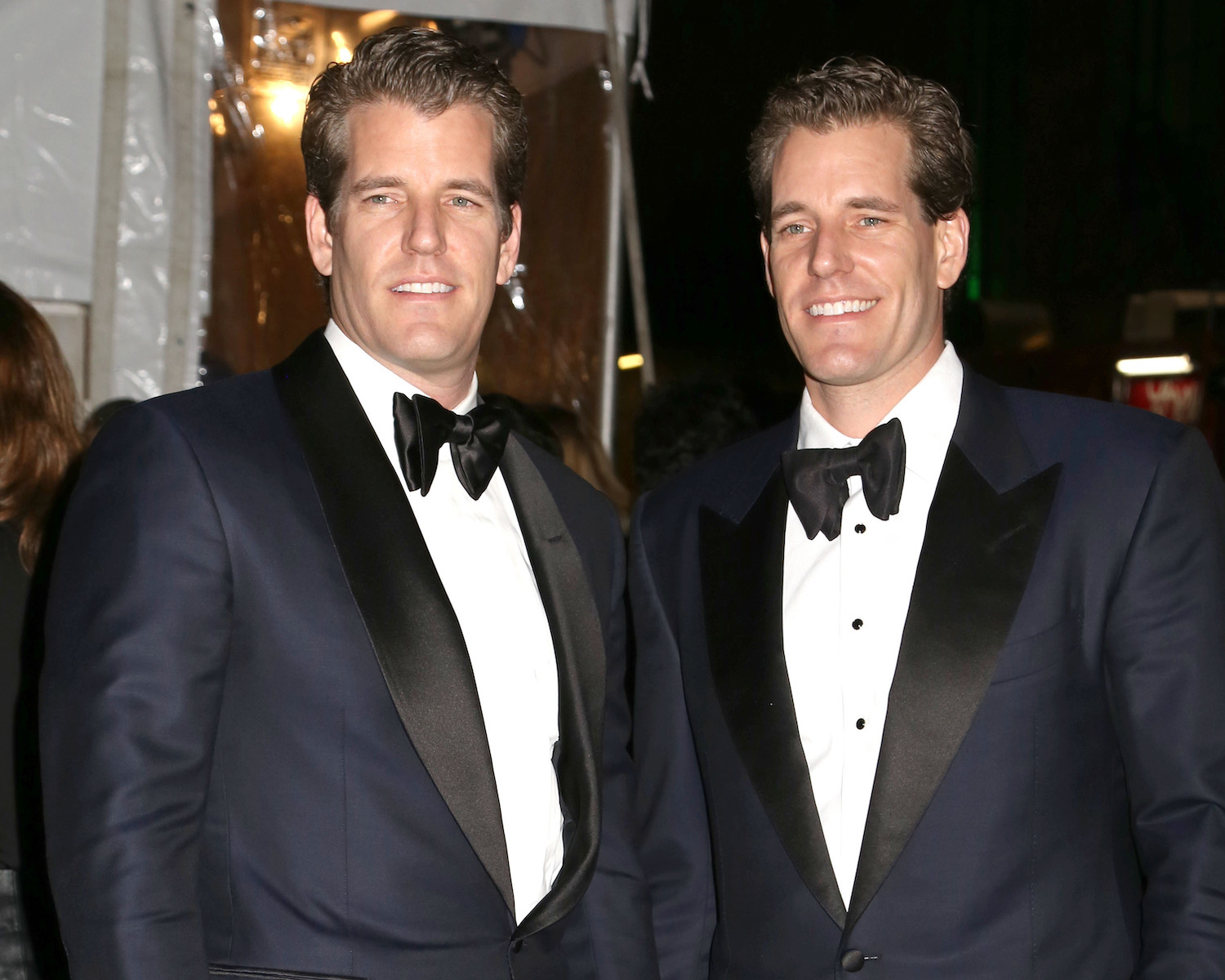

Bitcoin Price To Touch INR 3.5 Crore, says Winklevoss Twins

Bitcoin, popularly known as Digital Gold, has proved itself as a potential store of value after surviving the March 2020 market crash. This has led many investors to believe Bitcoin as the future and is being compared to gold – which for generations has been the world’s store of value.

In March 2020, markets across various asset classes including stocks, commodities, gold, and cryptocurrency all took a dive due to the uncertainty stemming from the pandemic. Since then the markets have started showing signs of recovery with markets almost reaching their pre-crash price levels. But Bitcoin and Gold outperformed every other asset class. They not only reached their previous levels but are inching towards a new all-time high.

This has led the Winklevoss twins to make a case that Bitcoin will replace gold and become the world’s store of value. And when this happens, Bitcoin would touch $500K (INR 3.5 crore ). Although the Winklevoss Twins haven’t predicted the exact time Bitcoin will touch INR 3.5 crore, they do make a compelling case regarding the prospects.

To understand Winklevoss Twin’s perspective regarding Bitcoin touching $500K (INR 3.5 Crore), we need to understand the current world reserve market.

Currently, Gold is the world’s reserve. Gold has two unique properties that make it the world’s currency – it doesn’t rust or decay, that means once mined gold stays safe from natural disasters, and secondly it is universally accepted, due to long history.

But Gold has had problems which weren’t possible to solve previously. But with the invention of computers and the internet, the problems related to gold can be solved to some extent. The problems outlined by Winklevoss Twins are – firstly, the exact amount of gold that is available isn’t known. Secondly, the movement of gold from one place to another is tough. Third, storage of gold is expensive, and lastly, which is a little far-fetched but not impossible is the advent of space mining would increase the supply of gold, thus bringing the price of the asset down.

“Currently, gold is a reliable store of value and the classic inflation hedge. Supply. The supply of gold is actually unknown. While gold remains scarce or “precious” on planet Earth, the same cannot be said with respect to our galaxy,” say Tyler Winklevoss.

Some economies of the world consider energy, namely crude oil, as another asset that can be considered as a store of value. While it works in the short term, the future of oil is unclear. Recent advancements in renewables technology and the general consensus of the world on leaving the dependence on oil doesn’t paint a bright picture on the future of oil.

According to the Winklevoss twins, Bitcoin solves all the problems with gold. Bitcoin is easy to store, and can easily be transferred anywhere securely. And once on the Bitcoin blockchain, the data is virtually incorruptible. Moreover, unlike gold, there will only be 21 million Bitcoin in the world.

The only problem with Bitcoin is that it’s not universally accepted currently. But that is changing slowly. In just 10 years, Bitcoin has gone from being entirely worthless to a $200 billion in market cap. And as more and more investors realize the potential of Bitcoin the more the value of Bitcoin increases. And once Bitcoin becomes a reliable store of value, Bitcoin can easily hit $500K – $600K.

“If central banks start to diversify their foreign fiat holdings even partially into bitcoin, say 10%, then 45x gets revised upward towards 55x or $600,000 USD per bitcoin, and so forth,” says Tyler Winklevoss

Some more stories you might like

From us to your inbox weekly.