What Is Causing Bitcoin (BTC) Price To Keep Going Up This Time?

Bitcoin has gone from INR 280,000 ($3,800) from March 2020 to a new all-time high of INR 2,380,000 ($32,300) at the time of writing. And many have been wondering about what’s causing the price of Bitcoin to rise rapidly.

In this we article we look at the dynamic behind’s Bitcoin price action and understand what is different this time than from the last few years.

To understand what’s causing the price of Bitcoin to rise, we first need to understand how the value of a Bitcoin is determined.

Unlike popular belief, Bitcoin inherently doesn’t have any value. 1 Bitcoin is equal to 1 Bitcoin everywhere. Bitcoin’s value comes from the fact that how much another person is willing to pay for a Bitcoin. And this is what gives Bitcoin its price (and thus creates trading opportunities).

The price is usually determined by a few factors namely the mining cost, demand, and the number of transactions taking place on the network.

“Bitcoin’s value comes from the fact that how much another person is willing to pay for a Bitcoin”

Mining Cost

Mining Bitcoin costs money and a lot. Mining Bitcoin requires specialized hardware running 24/7 with an efficient network and cooling infrastructure. To make matters worse, even by running these machines for 24/7 there’s no guarantee whether Bitcoin will be mined by the machine or not. This means for miners when they sell the mined bitcoin, they will try to make up for their fixed and variable costs.

Number Of Transactions

Bitcoin miners also make money via transaction fee. And more the transactions that take place on a Bitcoin network, the more work miners need to put in. This means miners would need to invest in faster hardware to keep up with the competition.

Demand

And lastly, the most important factor that determines the price of Bitcoin is the demand. If there is more demand (that is, more people are buying Bitcoins) then the miners can easily sell their Bitcoin at a higher price while if the demand is less, miners would need to sell their Bitcoins at a loss.

The above three are generally the most important factors when it comes to determining the price of a Bitcoin. But it’s 2020, a year of black swan events. And the Bitcoin market is no exception.

Covid-19 was the biggest thing to happen in 2020. Apart from lockdown, job losses, economy slowdown etc something else happened which was instrumental in pushing the idea of Bitcoin to the masses especially institutional investors – the Stimulus Bill 2020.

In April 2020, the US Congress approved a bill which was to give every US Citizen $1,200 and cash influx to cooperates to ensure workers salary. The bill was worth $1.2 trillion (yes with a ‘T’) which led many economists to believe would make the inflation rate go up thus bringing the value of the dollar down.

This has led many investors to invest their money into hedge assets such as gold, and (you guessed it) Bitcoin. And that’s what is different from the 2017 bull cycle. The 2017 cycle was led by retail investors, while the ongoing rally is fueled by institutional investors.

“It’s only after the first Stimulus Bill was announced that institutional investors saw the advantages of Bitcoin”

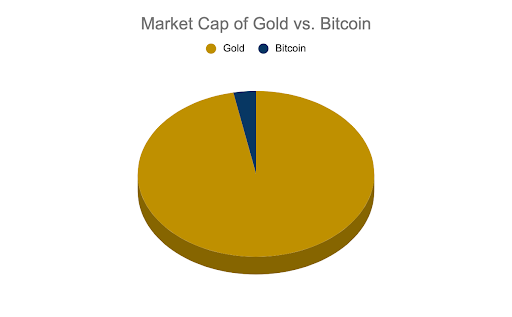

But why are institutional investors choosing Bitcoin as a safe haven rather than gold or equities?

Problems With Gold

Gold has been the go-to choice for investors and countries alike as a safe haven to hedge their money. That’s because of the universal acceptance of gold. But gold has one major flaw that is being made clear right now – the total supply of gold cannot be determined. With the invention of space mining (it’s sooner than most people think), and discovery of gold in ocean bed the gold supply can increase dramatically – which can potentially push the price of gold down.

Problems With Equities

Equities have never been considered as a good hedge for the simple reason that equities represent the general health of a country’s economy. While in a healthy economy, equities can be considered as a good bet, but if a black swan event (like COVID) happens, the equities market will be the first ones to crash.

Bitcoin To The Rescue

One of the major assurance for investors looking to hedge their asset is that the supply of the hedged asset wouldn’t increase manifolds. The scarcity should be maintained. Bitcoin provides this scarcity as there can only be 21 million Bitcoin in circulation, which is enforced via code and can be proved.

Moreover, Bitcoin although not universally accepted currently, has a strong community backing it which is pushing for its universal acceptance. And these factors do give institutional investors the confidence they are looking for. Now, don’t get us wrong – gold is still universally accepted (it has 5,000+ years of history backing it), but Bitcoin does create another safe haven for investors to diversify their portfolio.

But you might wonder if Bitcoin is a hedge against fiat then why did Bitcoin crash with the markets back in March. That’s because, at that point, the institutional demand wasn’t much. It’s only after the first Stimulus Bill was announced that institutional investors saw the advantages of Bitcoin. Moreover, another stimulus package of more than $1 trillion is in works which if passed will further decrease dollar’s value.

Apart from the demand created by institutional investors, another major factor that is responsible for this pump is the ‘2020 halving’.

On May 11th, 2020 an important event called halving took place on the Bitcoin blockchain. Every 210,000 blocks the miner rewards (that is the number of bitcoins a miner gets for mining a block) is halved from the previous value. This is done to ensure that the supply of Bitcoin is limited and was envisioned by Satoshi Nakamoto, the creator of Bitcoin.

Coming back, on May 11th, 2020 the miner rewards went down to 6.25 BTC from 12.5 BTC previously. That means miners will now get 6.25 BTC for mining instead of 12.5 BTC. Naturally, miners would want to sell their Bitcoin at a higher price to cover the cost of mining, which in thus pushed the price of new bitcoins up.

And there we have it. The institutional demand combined with halving is responsible for the current bull market.

The answer is yes, most probably. Usually, Bitcoin (or any other market for that) behaves in a cycle. That is if an asset price goes up, the price can also come down and vice versa. So it’s safe to say that in the future you will be able to buy Bitcoin for cheap but how cheap and when well that no one really knows.

Some more stories you might like

From us to your inbox weekly.